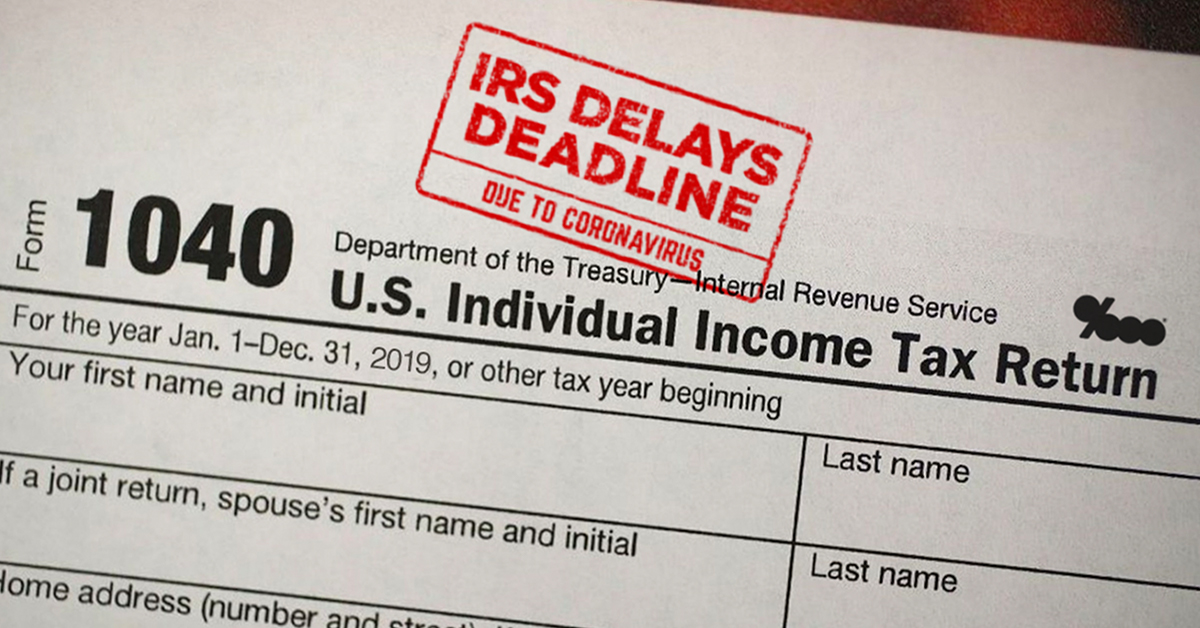

- The Internal Revenue Service announced on Tuesday, March 20 that taxpayers can delay their tax filing and payments up until July 15.

- During this deferral period, taxpayers won’t be subject to interest or penalties.

- Although this extension is limited to federal tax filing, states such as California have separately rolled out delays for state tax deadlines.

- You should still get your 2019 income tax return in as soon as possible, especially if you’re due a refund and need cash.

To get a free crypto capital gains estimate, try our crypto tax calculator.

Stay updated on the latest tax news.