- Klasing Associates predicts an incoming barrage of lawsuits against crypto tax evaders by the Internal Revenue Service.

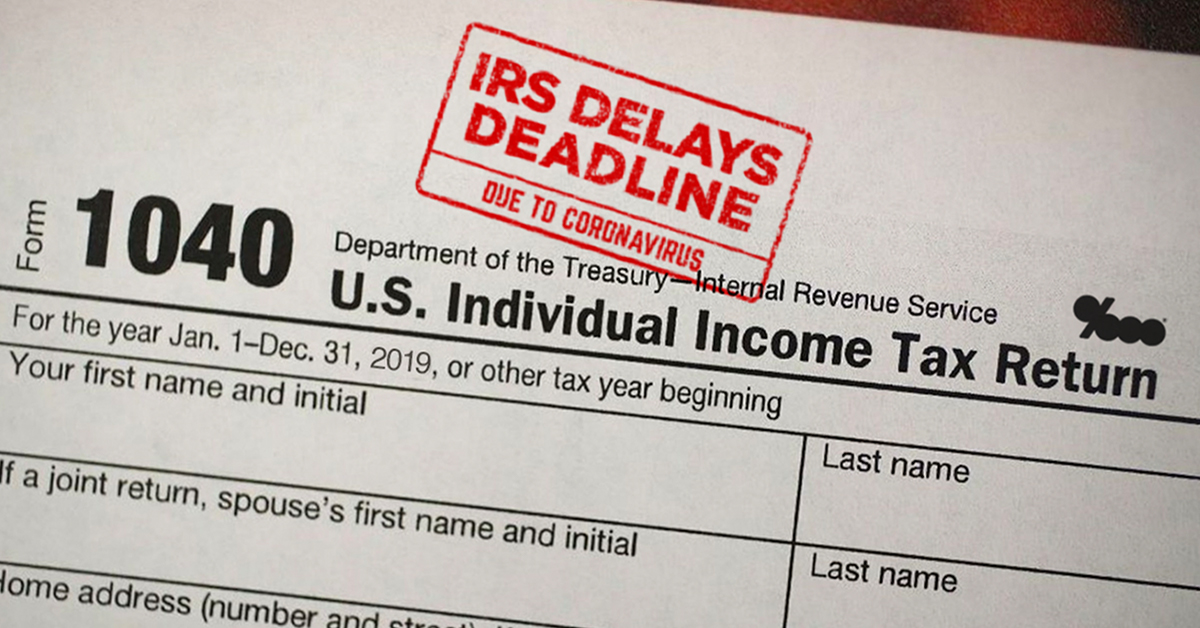

- This comes after the IRS added a cryptocurrency questions on Form 1040 which all United States tax payers must answer.

- According to Klasing, the IRS is looking to separate responsible crypto users and those who use digital currency to evade taxes.

- The Secretary of the Treasury has also emphasized efforts to prevent cryptocurrency from being viewed as “Swiss bank accounts.”.

- The March 3 summit in Washington D.C. hosted by the IRS will focus on striking a balance between taxpayer services and regulatory enforcement.

To read the full article, visit Inside Bitcoins.

For help with cryptocurrency tax filing, check www.cryptotax.com