Crypto Tax Newsletter

Updates on cryptocurrency tax law, deadlines, and more... delivered every few weeks.

We don't accept any new clients for 2021 tax season, see you next year!

We help you generate IRS compliant tax reports, while maximizing your refund. Simple, accurate, and trusted.

Securely connect your exchanges and wallets, and seamlessly import your trade history.

We inspect your balances and trade history, and choose the right tax calculation method for you.

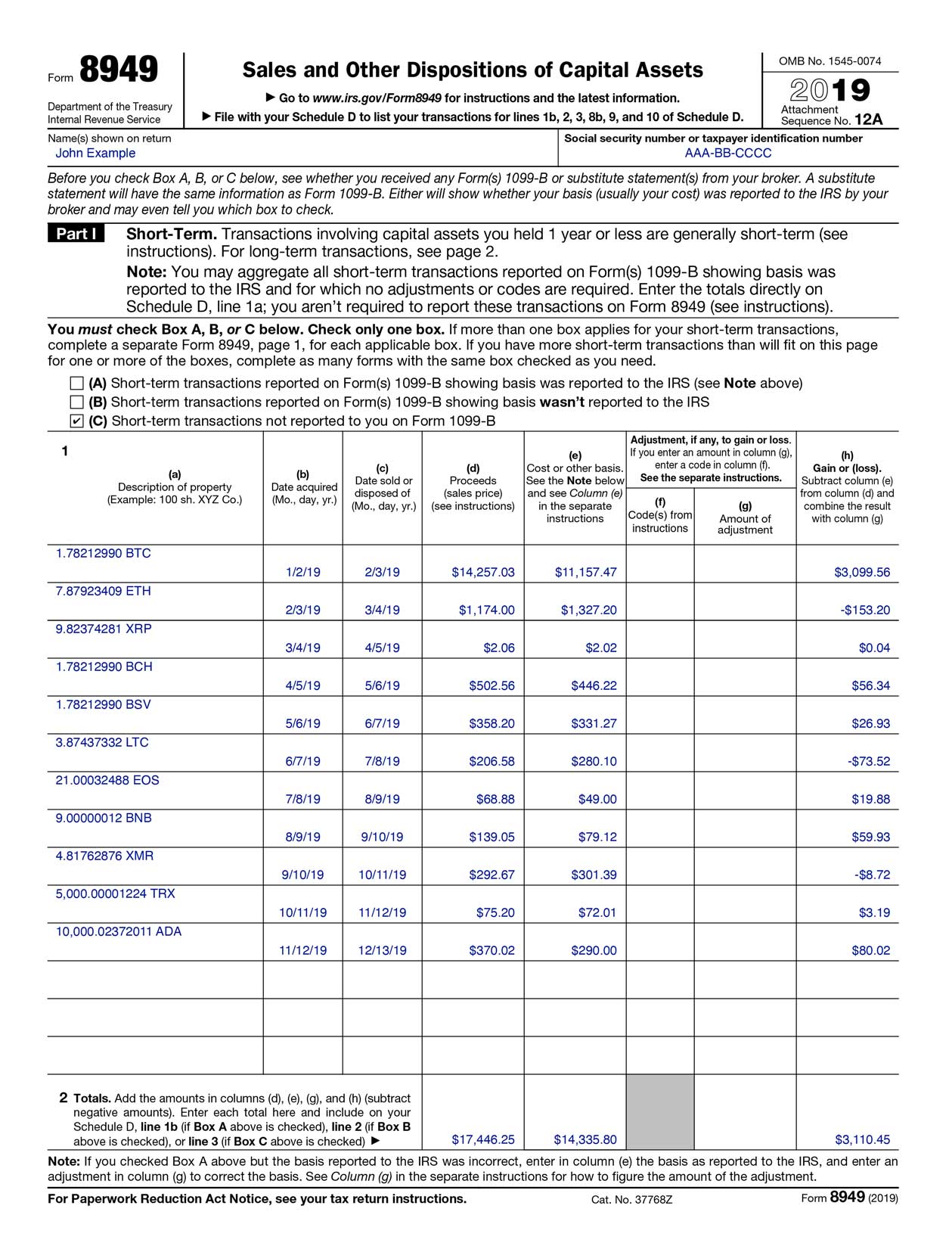

Get your custom 8949 tax form and instructions on how upload it to your filing software or CPA.

Connect via API keys or CSV upload to any exchange or wallet.

Simply upload your reports to your favorite e-filing service or send to your accountant. If you don't have one, we can help you too.

Seamlessly integrated with TurboTax and your accountant's software. We offer full support in US, UK, Canada, Australia, and partial support for every other country.

TurboTax support

International support

Mining & CapEx

FBAR support

You have investments to make. Stop worrying about record keeping, filing & keeping up to date with the evolving crypto tax code. Let us do that for you.

Satisfaction

Support

Exchanges

choose a plan based on your exchanges & trading volume

one time

Robinhood, Cash App

Chat Support

Error Reconciliation

Tax-Loss Harvesting

IRS Forms

Capital Gains Report

TurboTax integration

TaxAct Integration

one time

Import All Exchanges

Import Wallets / Apps

Chat + Priority Support

Error Reconciliation

Tax-Loss Harvesting

IRS Forms

Capital Gains Report

TurboTax integration

TaxAct Integration

one time

Volume $1M+

Dedicated Support

Error Reconciliation

Tax-Loss Harvesting

IRS Forms

Capital Gains Report

TurboTax integration

TaxAct Integration

If you have bought, sold, mined, been airdropped, or received cryptocurrency in exchange for work, then you might owe taxes on your crypto.

If you hold a cryptocurrency for one year or less, then it’s considered short-term and is taxed as regular income. Long-term capital gains tax is typically much lower.

Virtual currency is considered property, and is taxed as one. This means that capital gains tax, and other taxing principles are applicable for cryptocurrency.

Your cost basis is the amount you spend in order to obtain your crypto, including fees and other acquisition costs. This can be adjusted based on certain deductibles and expenditures.

Calculate your cryptocurrency taxes and get your IRS compliant tax reports. Simply import your data and we will take care of the rest.

Get Started