Calculating your cryptocurrency taxes can be a frightening experience. But it doesn’t have to be! This guide will show you how you can generate your IRS compliant reports in 5 easy steps.

It’s important to remember that, to accurately calculate your taxes, you’ll need to import your entire cryptocurrency transaction history. This is needed to generate your reports, which include:

- Form 8949

- TurboTax and TaxACT exports

- Transaction History

- Capital Gains Summary

- Income Report (for airdrops, payments, etc…)

These allow you to file your taxes through online platforms like TurboTax, and through traditional methods like an accountant.

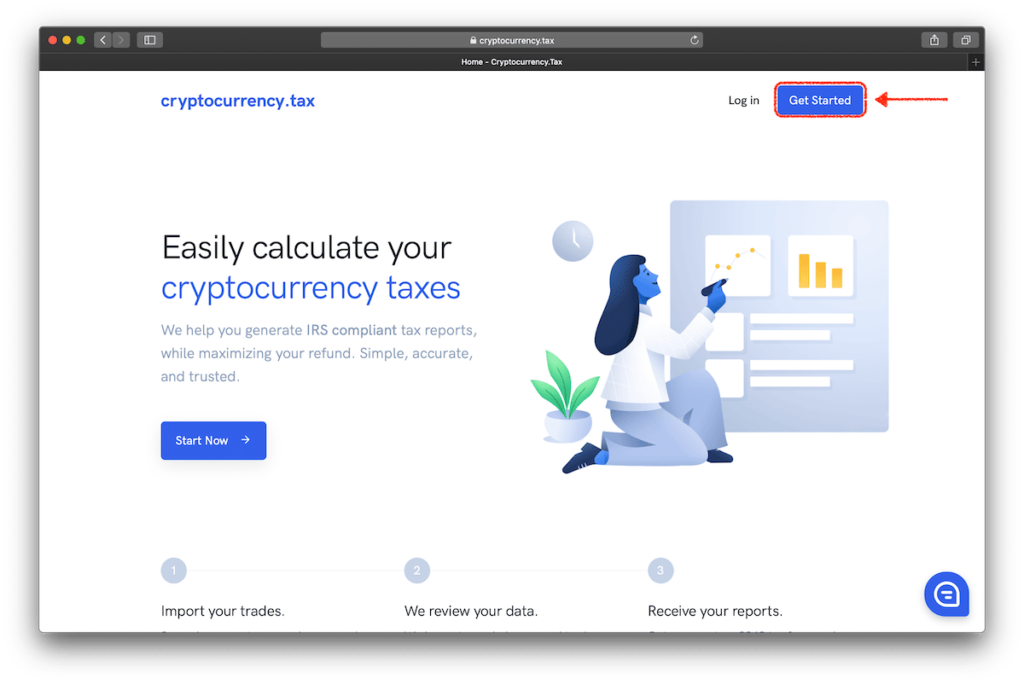

Step 1: Create an Account:

1.1 Visit cryptotax.com and click on “Get Started“.

1.2 Type a username, your email address, and your password.

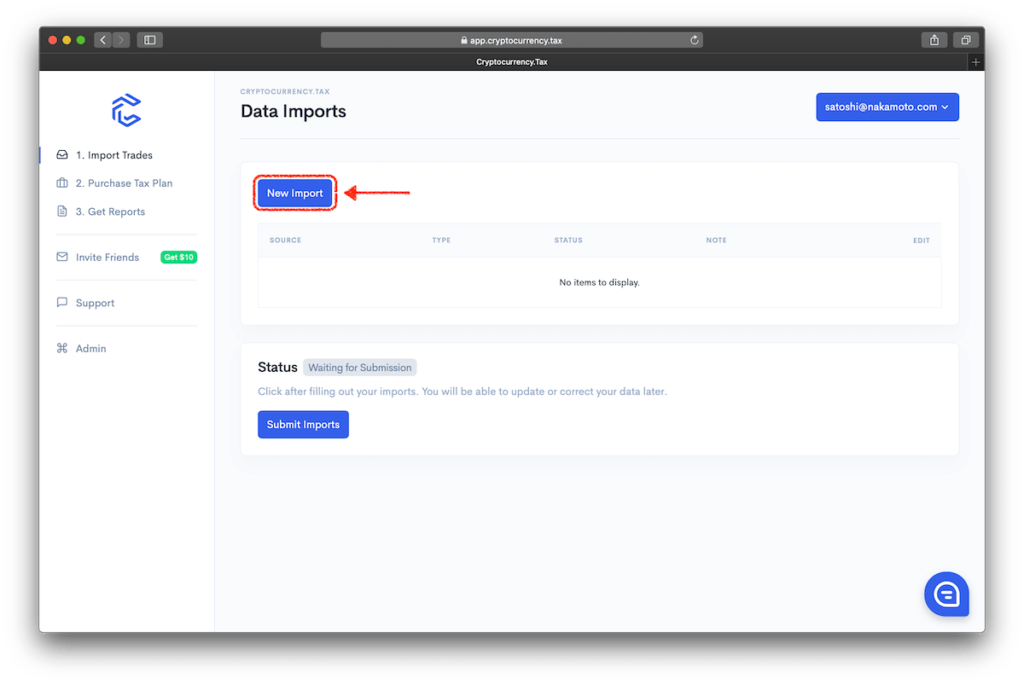

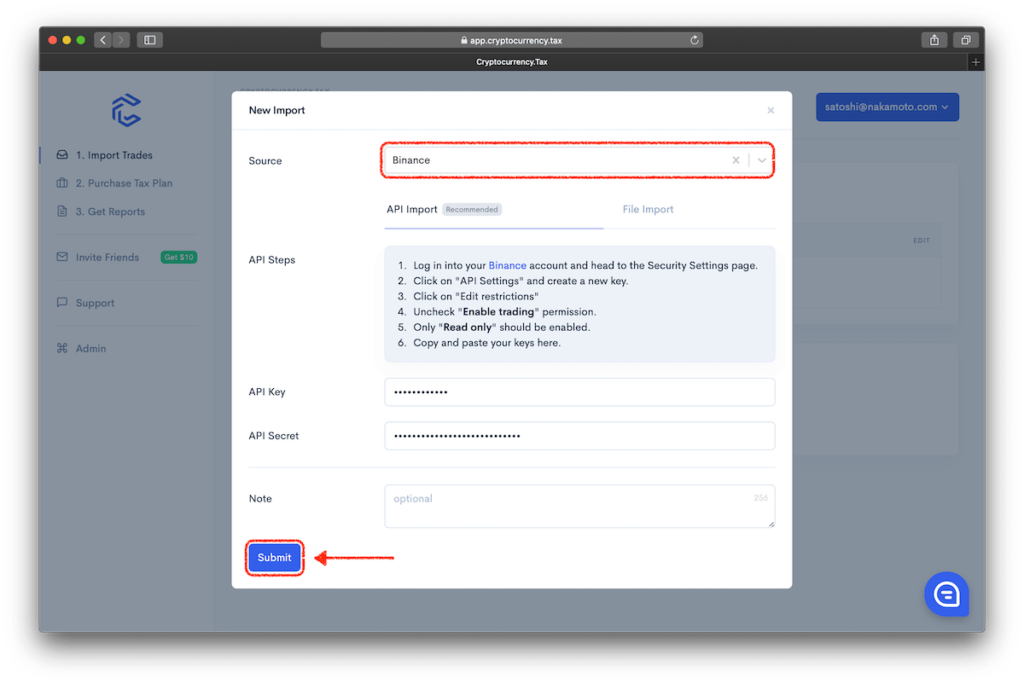

Step 2: Import Your Trades

2.1 Click on “New Import“.

2.2 Search for the exchange/wallet you use.

2.3 Follow the import instructions. You can choose whether to import via API (recommended), or via CSV upload.

2.4 Click “Submit“.

2.5 After importing all your sources, click on “Submit Imports“.

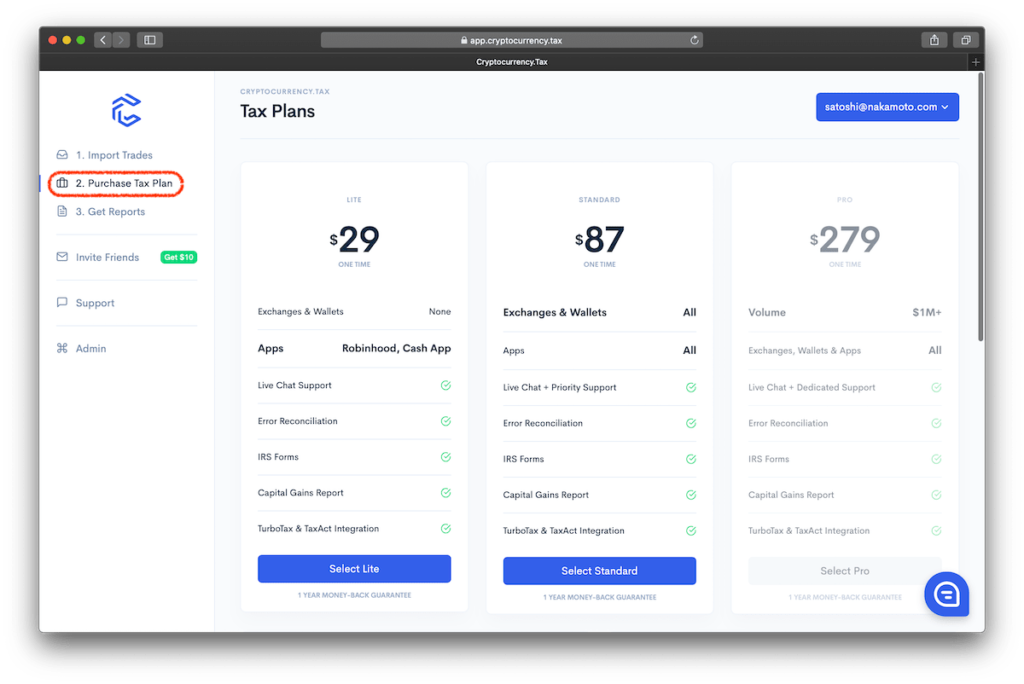

Step 3: Select a Plan

3.1 Choose the appropriate tax plan and make a purchase. There are 3 tiers:

Lite – $29: If you only use exchange apps like Robinhood and Cash App

Standard: $87: All exchanges and apps, and under $1M in transactions

Pro: $279: All exchanges and app, and over $1M in transactions

Step 4: Wait 24-Hours

We Manually review your sources and transactions, and make sure you use the cost basis method that produces the lowest tax bill. Once you’re reports are ready, you will receive an email letting you know.

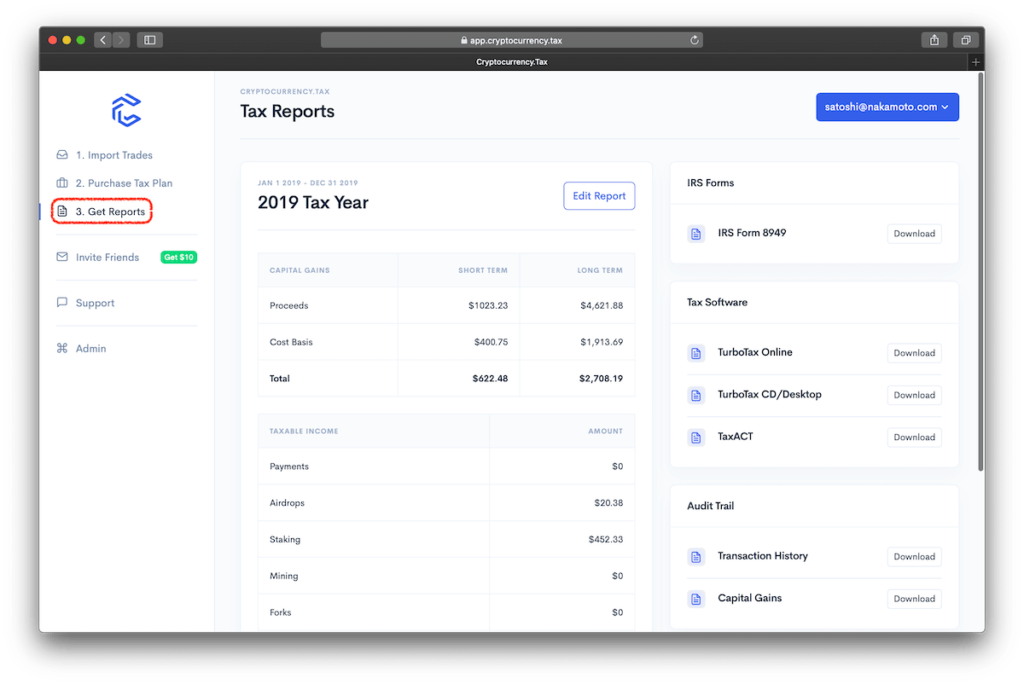

Step 5: Access Your Reports

Once you reports are ready, you’ll be able to download everything you need to file your taxes.

We provide tax software exports, IRS forms for traditional filing methods, and audit trail files like, transaction history and capital gains summary.

If you have any questions or concerns, please send us an email at [email protected].