In 2014, the Internal Revenue Service (IRS) published Notice 2014-21, which laid out rules and regulations for how virtual currencies are taxed. For tax purposes, virtual currencies such as cryptocurrencies are treated as property, not currency. A way to think about this is to imagine that buying bitcoin (BTC) entitles you to a “share” in the network, the BTC blockchain. One satoshi, the smallest unit of BTC, would equal one share. In this case, owning crypto is similar to owning stock in a corporation – albeit virtual – and is considered by the IRS as an intangible asset.

Because cryptos are taxed as property (an asset), they are subject to tax laws governing capital gains and capital losses. Capital gains and losses result from a taxable event. The IRS recognizes three taxable events:

- Selling crypto (mined or purchased)

- Trading crypto-to-crypto

- Using crypto (mined or purchased) to buy goods or services

Importantly, the following are not taxable events and don’t require reporting on annual tax returns:

- Buying and holding crypto

- Sending cryptos wallet-to-wallet or exchange-to-exchange

There are two types of capital gains/losses: short-term and long-term.

- Short-term: Buying, selling, or trading an asset after holding for less than one year

- Long-term: Buying, selling, or trading an asset after holding for more than one year

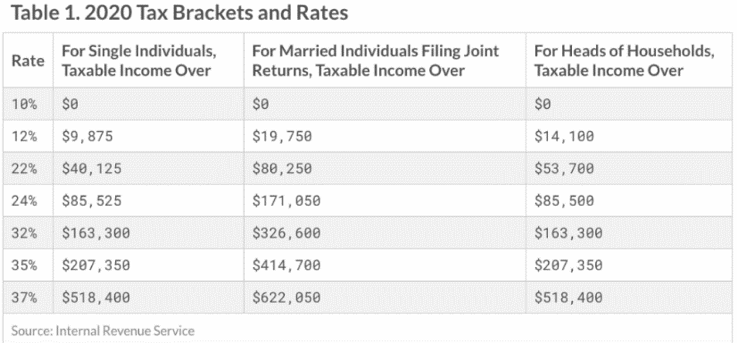

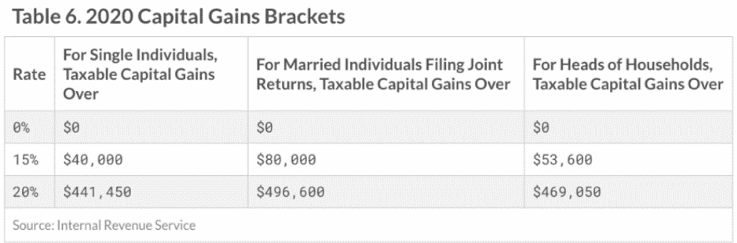

Below are the short- and long-term capital gains tax brackets for 2020. For many people, capital gains won’t exceed 24% in the short-term (the income tax rate) and 15% in the long-term.

The IRS requires that all crypto transactions, no matter how small, must be reported on a yearly tax return. The IRS maintains a FAQ on virtual currencies, which goes into further detail on the variety of situations. U.S. taxpayers must therefore keep a record of all transactions: buying, selling, investing in, or using cryptocurrencies to pay for goods and services. Use IRS form 8949 to file your cryptocurrency taxes, which is the Sales and Other Dispositions of Capital Assets form.

Properly tracking crypto transactions for tax purposes can be complicated. Don’t be tempted to avoid reporting to the IRS. In July of 2019, the IRS sent many crypto investors letters warning that all virtual currencies are subject to taxation.

Let’s see an example of how taxing cryptos works in practice.

- 1 BTC is purchased on Binance for $8,000 (not taxed)

- 1 BTC worth $8,000 is transferred to Gemini (not taxed)

- 1 BTC worth $8,000 is traded for 60 ethereum (ETH), a gain of $400 (taxed)

- 50 ETH is held for two years (not taxed)

- 50 ETH is sold on Coinbase for $12,000, a gain of $2,000 (taxed)

In our example, we have two taxable events, which happen when BTC is exchanged for ETH and when the ETH is sold later. What are our taxes for the three years? We will assume our yearly income is $50,000 filing single.

- Year 1: gain of $400 reported from converting BTC into ETH. The 22% short-term tax rate applies, so $88 ($400 x 22%) is owed in taxes.

- Year 2: no taxable event, nothing reported.

- Year 3: gain of $4,000 reported from the sale of ETH. The 15% long-term tax rate applies, so $600 ($4,000 x 15%) is owed in taxes.

While this may seem straightforward, there are two additional steps to find the exact amount due in taxes. The first is to find the cost basis of the investment, and the second is to determine the fair market value. Cost basis is how much total money was required to purchase a cryptocurrency, including any fees. Below is the formula:

- Cost Basis = (Total Purchase Price + Fees) / Quantity

In our earlier example, let’s say we paid 2% to Gemini for the BTC to ETH trade, at a rate of $140 per ETH. Our cost basis would be ($8,000 + (2% x $8,000)) / 60 = $136 per ETH or $8,160 total

Next, we need to find the capital gain/loss. To do this, we need to know the fair market value. This is the sale price of the asset. Using our example from year 3, we sold our 60 ETH for $12,000, roughly $200 per ETH. We now use the below formula:

- Fair Market Value – Cost Basis = Capital Gain/Loss

In our example, this would be $12,000 – $8,160 = $3,840 is our total capital gain. Importantly, this is $160 less than our example in year 3. The fee effectively reduces our tax burden.